Condo Insurance in and around Chesapeake

Condo unitowners of Chesapeake, State Farm has you covered.

Cover your home, wisely

Home Is Where Your Condo Is

Looking for a policy that can help insure both your condo and the clothing, sports equipment, pictures? State Farm offers terrific coverage options you don't want to miss.

Condo unitowners of Chesapeake, State Farm has you covered.

Cover your home, wisely

State Farm Can Insure Your Condominium, Too

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Alvin Keels can be there whenever the unexpected happens to help you submit your claim. State Farm is there for you.

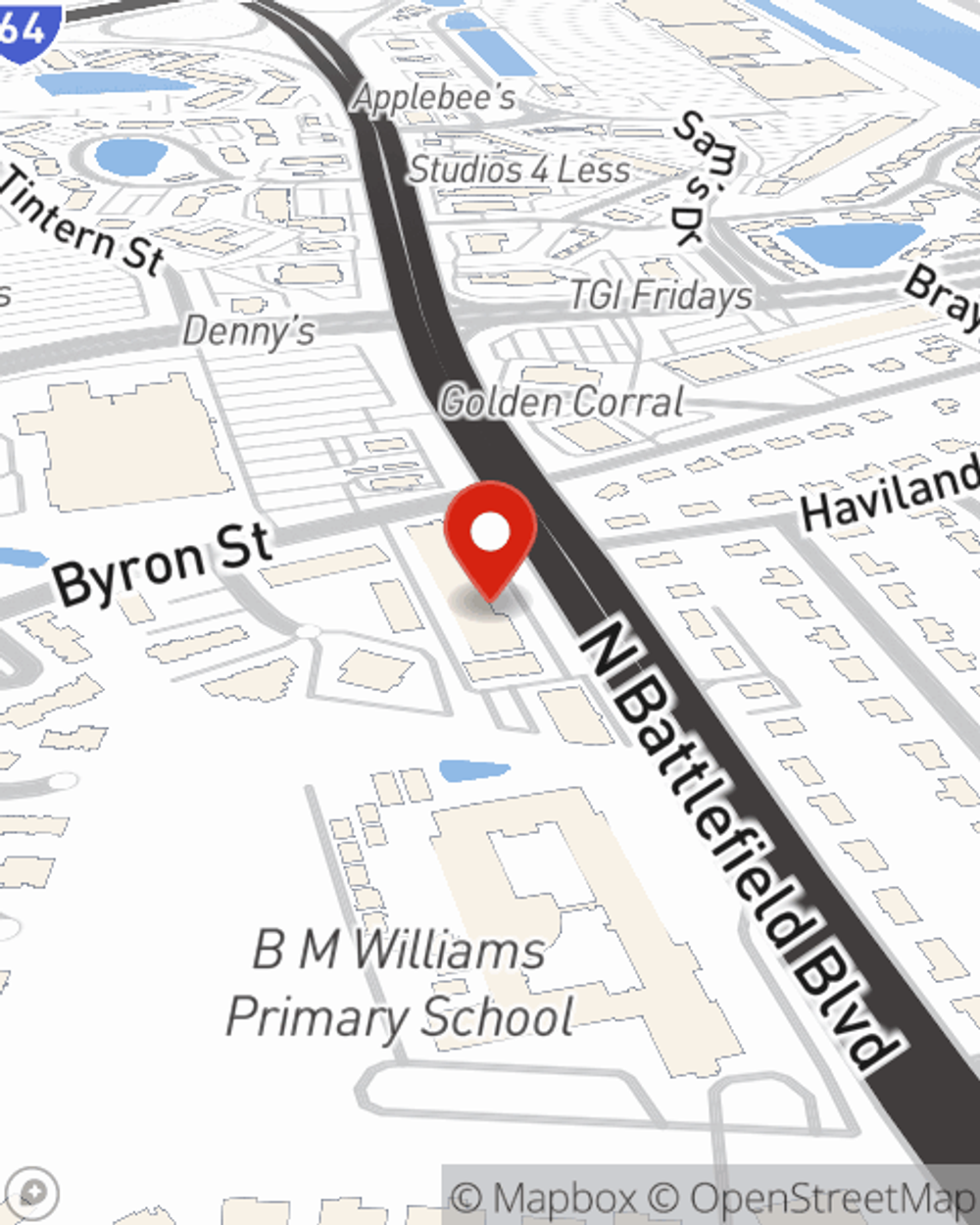

As a value-driven provider of condo unitowners insurance in Chesapeake, VA, State Farm helps you keep your belongings protected. Call State Farm agent Alvin Keels today for help with all your condominium unitowners insurance needs.

Have More Questions About Condo Unitowners Insurance?

Call Alvin at (757) 547-4553 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Alvin Keels

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.