Business Insurance in and around Chesapeake

Chesapeake! Look no further for small business insurance.

Cover all the bases for your small business

Help Prepare Your Business For The Unexpected.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent Alvin Keels recognizes the work that it takes and would love to help lift some of the burden. This is insurance you'll definitely want to investigate.

Chesapeake! Look no further for small business insurance.

Cover all the bases for your small business

Insurance Designed For Small Business

State Farm has been helping small businesses grow since 1935. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are a fence contractor or a photographer or you own a travel agency or an art store. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Alvin Keels. Alvin Keels is the person who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

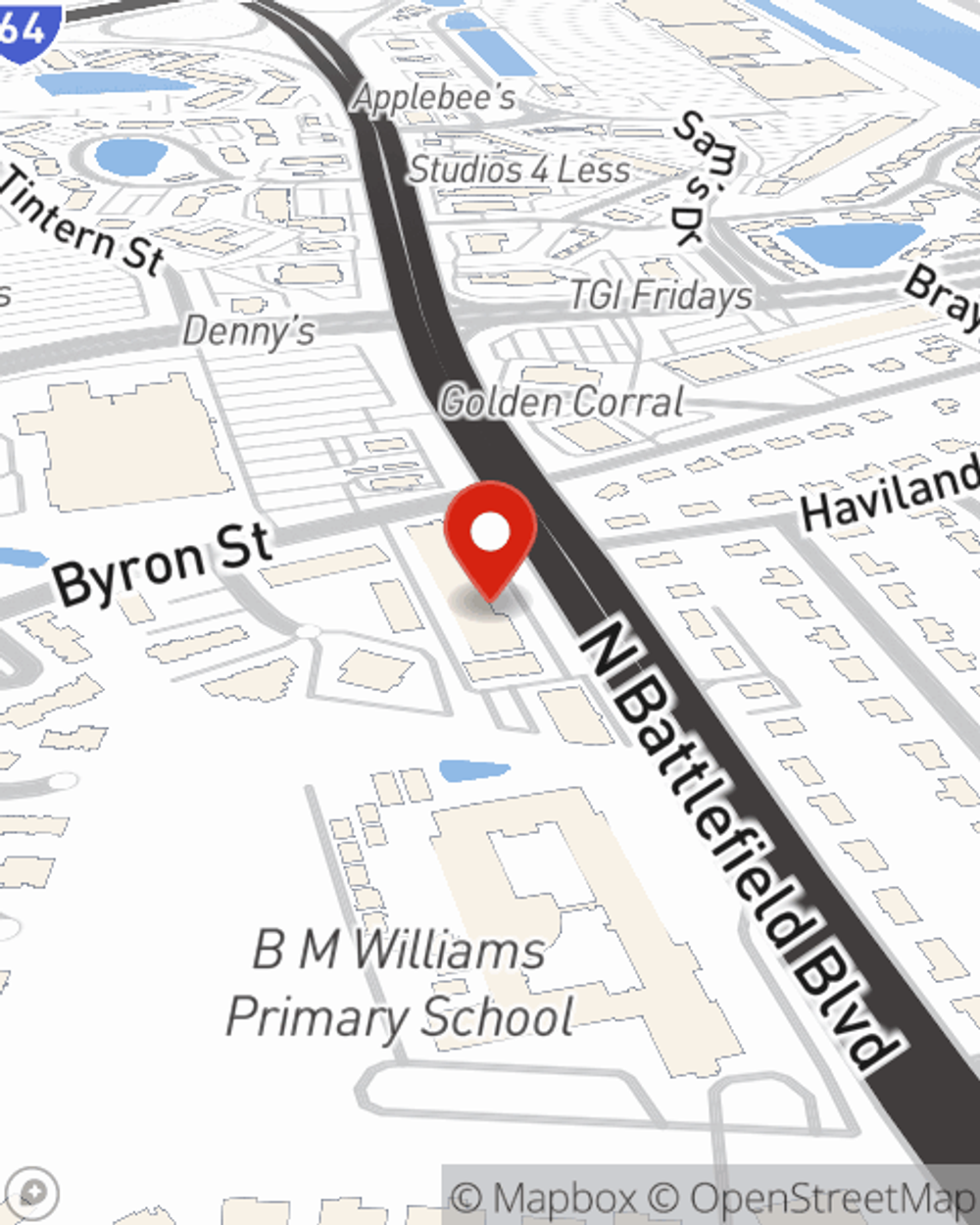

At State Farm agent Alvin Keels's office, it's our business to help insure yours. Call or email our terrific team to get started today!

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Alvin Keels

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.